Posted: 28/08/2019

In today’s insecure commercial lettings market, it is becoming increasingly common for landlords to take a significant rent deposit when granting a new lease and to enforce their rights under the rent deposit deed. This is putting the drafting and enforcement of rent deposit deeds under scrutiny. How do the parties to a rent deposit deed protect their positions when the landlord assigns the reversion to the lease? In this article, we assume that the rent deposit account is in the landlord’s name and that the tenant’s interest in the account - and the monies in it - are charged to the landlord.

What happens when:

A rent deposit deed that relates to a “new” tenancy is a “collateral agreement” to the tenancy, as defined in section 28(1) of the Landlord and Tenant (Covenants) Act 1995 (the 1995 Act). Covenants contained in collateral agreements are “covenants” for the purposes of the 1995 Act.

Section 3(3) of the 1995 Act says that, where a landlord transfers or assigns its interest, the transferee or assignee will become bound by the landlord’s covenants whether they are covenants contained in the tenancy or in the rent deposit deed (except where they are stipulated to be personal) and will become entitled to the benefit of the tenant’s covenants. This is a statutory exception to the established principle that the burden of a contract cannot be assigned. In these circumstances, the covenants contained in the rent deposit deed are enforceable by and against the new landlord.

Transferring the charge

The charge on the rent deposit account does not fall within the definition of a “covenant” under the 1995 Act. A charge is not a “term, condition or obligation”; it is an encumbrance on the asset that is subject to the charge and gives the landlord the right to appropriate the charged property.

The fact that the benefit and burden of the rent deposit deed covenants have transferred to the landlord’s successor by virtue of the 1995 Act does not mean that the benefit of the charge has also been transferred. If the parties do not take further action, the beneficiary of the charge may be the old landlord even though he is no longer able to enforce the covenants under the deed.

Defining the “landlord”

If the deed is personal to the named landlord, a new rent deposit deed containing a new charge is required. A new charge will create a chargee/chargor relationship between the new landlord and the tenant. Without a new charge, although the new landlord can enforce the tenant’s covenants in the deed, it will be an unsecured creditor with no priority in a tenant insolvency.

The central purpose of a rent deposit deed is to protect the landlord in the case of tenant insolvency. In a worst-case scenario, a new landlord may find that the deposit is entirely swallowed up by the creditors ranking above it, resulting in the total loss of its security.

It is common for rent deposit deeds to define the “landlord” to include successors in title, so that the tenant’s charge of its interest in the deposit account is to the current and all future landlords. The benefit of the charge will automatically transfer when the landlord transfers or assigns its interest.

Release under the 1995 Act

Under section 6 of the 1995 Act, the outgoing landlord will remain liable for the landlord’s covenants in the rent deposit deed until it obtains a release from the tenant.

The landlord is released if it serves notice on the tenant telling the tenant of the proposed assignment and requesting that it is released from the landlord’s covenants and:

If this procedure is not followed, a landlord remains liable for the performance of the landlord covenants. However, owing to complications arising if some (but not all) tenants release the landlord, it may not be appropriate in every case to seek such a release.

Summary

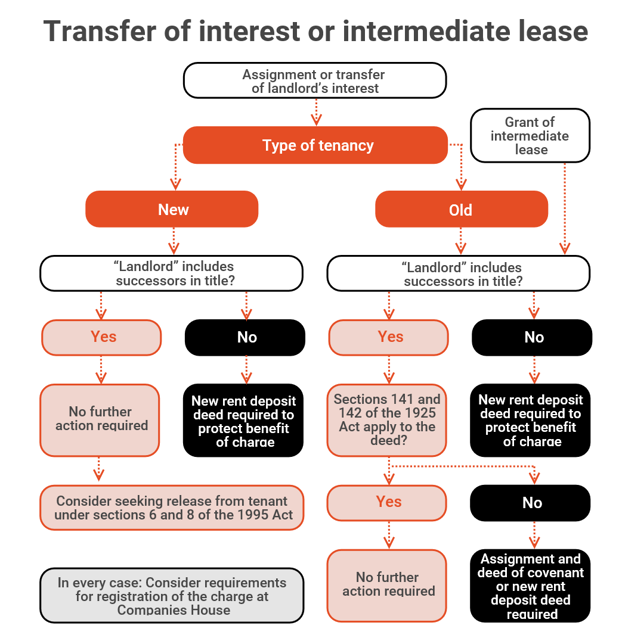

If a rent deposit deed to a “new” tenancy incorporates the landlord’s successors in title, no action needs to be taken. Where appropriate, a landlord should consider following the procedure in section 8 of the 1995 Act to release its liability to the tenant.

If the deed does not incorporate successors in title, a new rent deposit deed will need to be entered into between the tenant and the landlord’s successor. The covenants will be extinguished and the successor will offer new covenants.

One of two different sets of rules will govern:

Sections 141 and 142 of the Law of Property Act 1925

If the lease and/or the rent deposit deed define covenants given in the rent deposit deed as lease covenants, then sections 141 and 142 of the Law of Property Act 1925 (the 1925 Act) apply. As lease covenants they are enforceable by and against the landlord’s successor in title automatically. To pass on the benefit of the charge automatically, the charge must be drafted to refer to successors in title.

Common law rules

If the covenants in the rent deposit deed are not lease covenants, the common law rules for the assignment of contractual obligations and privity of contract apply.

The benefit of a contract may be assigned. The assignment must be absolute, in writing and signed by the assignor, and notice of the assignment must be given to the tenant.

The burdens of a contract may not be assigned. When the rent deposit deed relates to an “old” tenancy, the parties must create privity of contract between the new landlord and the tenant. Two methods are available:

The 1995 Act does not apply where the landlord grants an intermediate lease of the property. The granting of a new lease is not an “assignment” and the intermediate tenant is not treated as stepping into the landlord’s shoes.

The grant of an intermediate lease may qualify as a disposition of the reversionary estate immediately expectant on the determination of the term of the lease to which the rent deposit deed relates. The provisions of sections 141 and 142 of the 1925 Act may apply as above and, if they do not, the common law rules apply.

Charges created by companies on or before 5 April 2013 had to be registered at Companies House within 21 days of the date of execution or they are void. If the charge created by a rent deposit deed is not registered, a tenant’s insolvency practitioner will assert that the charge is void and the landlord is an unsecured creditor.

The landlord has two options:

Charges created on or after 6 April 2013 are not required to be registered at Companies House.

In summary, rent deposit deeds should be given appropriate consideration both during the drafting process and during due diligence relating to the disposition of the landlord’s interest.

This article was first published in Estates Gazette in June 2019.